Simulating Black-Scholes with Monte Carlo#

Black Scholes#

\[

C = S_0 \Phi(d_1) - K e^{-rT} \Phi(d_2)

\]

\[

d_1 = \frac{\ln\left(\frac{S_0}{K}\right) + \left(r + \frac{\sigma^2}{2}\right)T}{\sigma \sqrt{T}}, \quad d_2 = d_1 - \sigma \sqrt{T}

\]

Assumptions:

Stock follows geometric Brownian motion.

Constant risk-free rate

No arbitrage.

No transaction costs.

European option

Geometric Brownian Motion#

\[dX_t=\mu X_tdt+\sigma X_tdW_t\]

where \(\mu\), \(\sigma\in\mathbb{R}\) and \(W_t-W_s\sim\mathcal{N}(0, t-s)\).

Discrete Approximation of Brownian Motion#

We will use a Euler discretisation for the simulation.

\[X_{t+1}=X_t+\mu X_t dt+\sigma X_tdW_t\]

\[

dW_t \sim N(0, dt)

\]

Note $\( W_t = W_{t-1} + dW_t, \quad \text{where } dW_t \sim N(0, dt). \)\( or \)\( W_t = \sum_{i=1}^n dW_i, \)$

so $\( \text{Var}(W_t) = n \cdot dt \)$

In continuous-time process#

\[

\mathbb{E}[W_t^2] = \text{Var}(W_t) = T

\]

This means if we set dt = 0.01, and simulate for n = 100 timestamps, this is equivalent to T = 1 year in Black-Scholes

Black-Scholes#

\[

d_1 = \frac{\ln(S / K) + (r + 0.5 \sigma^2) T}{\sigma \sqrt{T}}

\]

For call: $\( \Delta = N(d1) \)$

For put: $\( \Delta = N(d1) - 1 \)$

Gamma: $\( \Gamma = \frac{\phi(d_1)}{S \sigma \sqrt{T}} \)$

from base import GBM, Option

import torch

import matplotlib.pyplot as plt

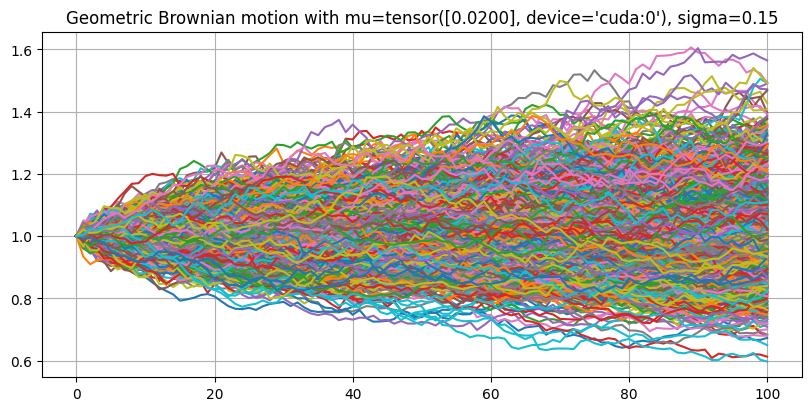

mu, sig = 0.02, 0.15

x0, strike = 1.0, 1.0

dt, T = 0.01, 1.0

call = Option(mu, sig, x0, strike, dt = 0.01, n_paths=100000, option_type='Call', device='cuda')

call.simulate()

call.compute_payoff()

print('price', call.price)

print('delta', call.compute_delta())

Simulation done

price 0.06985085465508467

delta 0.5951619148254395

call.black_scholes(print_=True)

price: 0.06961840391159058

Delta: 0.5825156569480896

Gamma: 2.6025195121765137

0.06961840391159058

call.plot()

Too many paths to plot. Plotting first 1000 paths

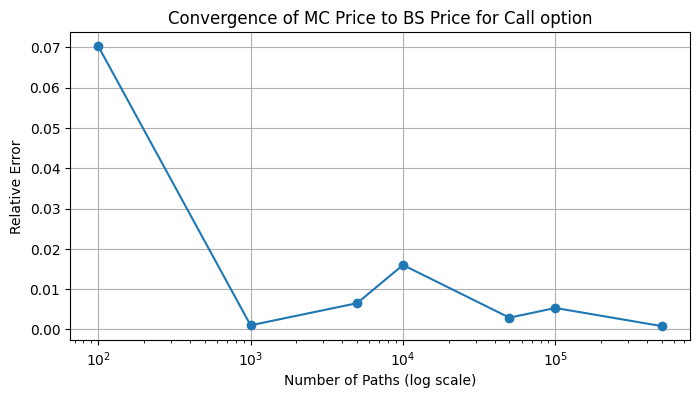

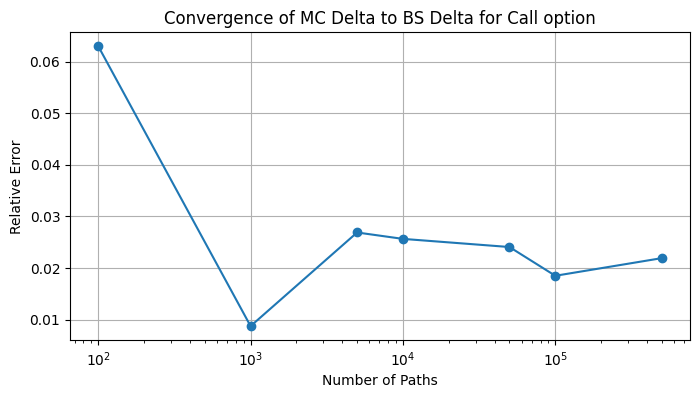

n_paths_values = [int(x) for x in [100, 1000, 5000, 10000, 50000, 1e5, 5e5]]

call.plot_accuracy(n_paths_values)

Simulation done

Simulation done

Simulation done

Simulation done

Simulation done

Simulation done

Simulation done

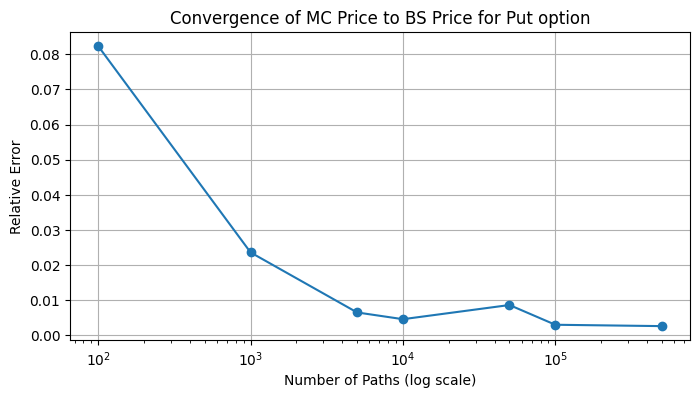

put = Option(mu, sig, x0, strike, dt = 0.01, n_paths=1000, option_type='Put', device='cuda')

put.plot_accuracy(n_paths_values)

Simulation done

Simulation done

Simulation done

Simulation done

Simulation done

Simulation done

Simulation done

call.plot_delta(n_paths_values)

BS Delta: 0.5825156569480896

Simulation done

MC Delta: 0.6192039847373962

Simulation done

MC Delta: 0.5774345397949219

Simulation done

MC Delta: 0.5981668829917908

Simulation done

MC Delta: 0.597444474697113

Simulation done

MC Delta: 0.5965250134468079

Simulation done

MC Delta: 0.5932795405387878

Simulation done

MC Delta: 0.5952727794647217

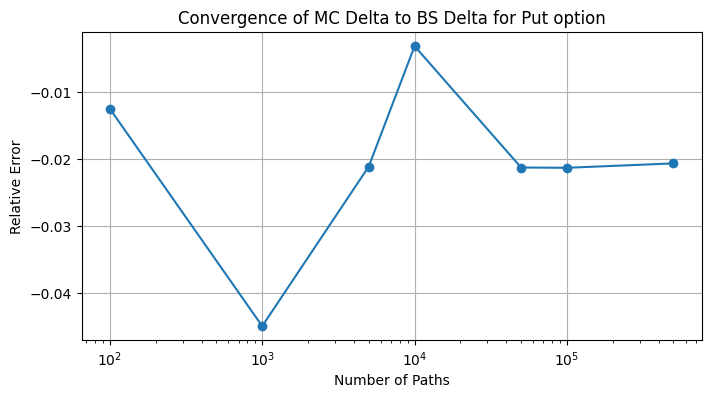

put.plot_delta(n_paths_values)

BS Delta: -0.4174843430519104

Simulation done

MC Delta: -0.4226855933666229

Simulation done

MC Delta: -0.4362458288669586

Simulation done

MC Delta: -0.4262937903404236

Simulation done

MC Delta: -0.41878122091293335

Simulation done

MC Delta: -0.4263526201248169

Simulation done

MC Delta: -0.4263691008090973

Simulation done

MC Delta: -0.4260958731174469